How to Trade Forex and Withdraw on XTB

How to Trade on XTB

How to place an Order on XTB [Web]

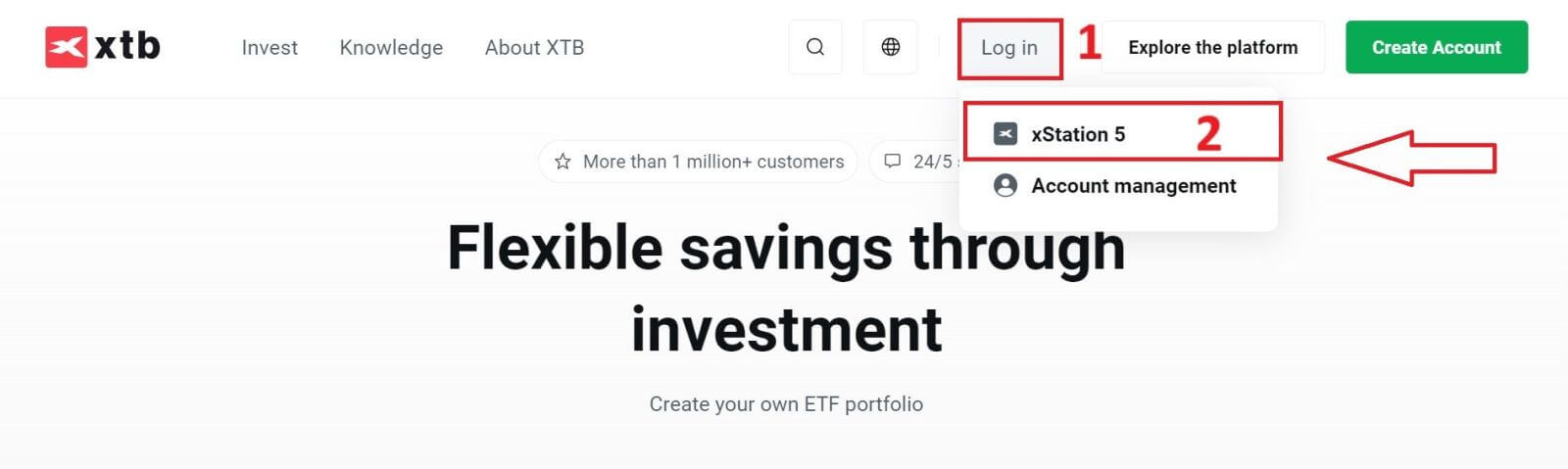

First, please go to the XTB homepage and click on "Log in", then choose "xStation 5".

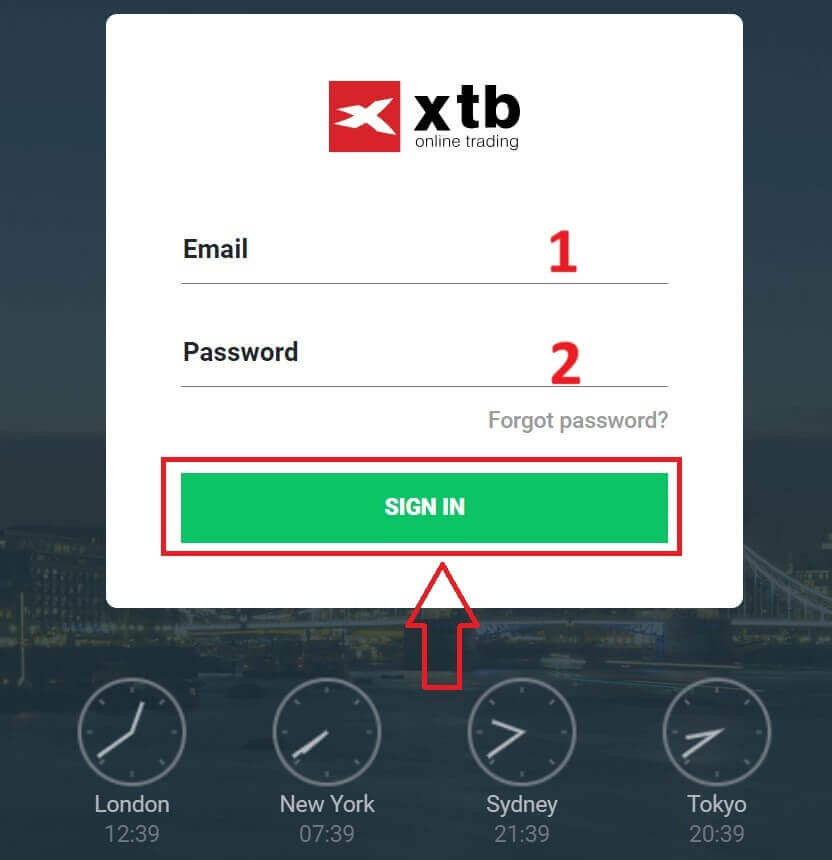

Next, you will be taken to the login page. Enter the login details for the account you previously registered in the appropriate fields, and then click "SIGN IN" to continue.

If you haven’t created an account with XTB yet, please check out the instructions in this article: How to Register Account on XTB.

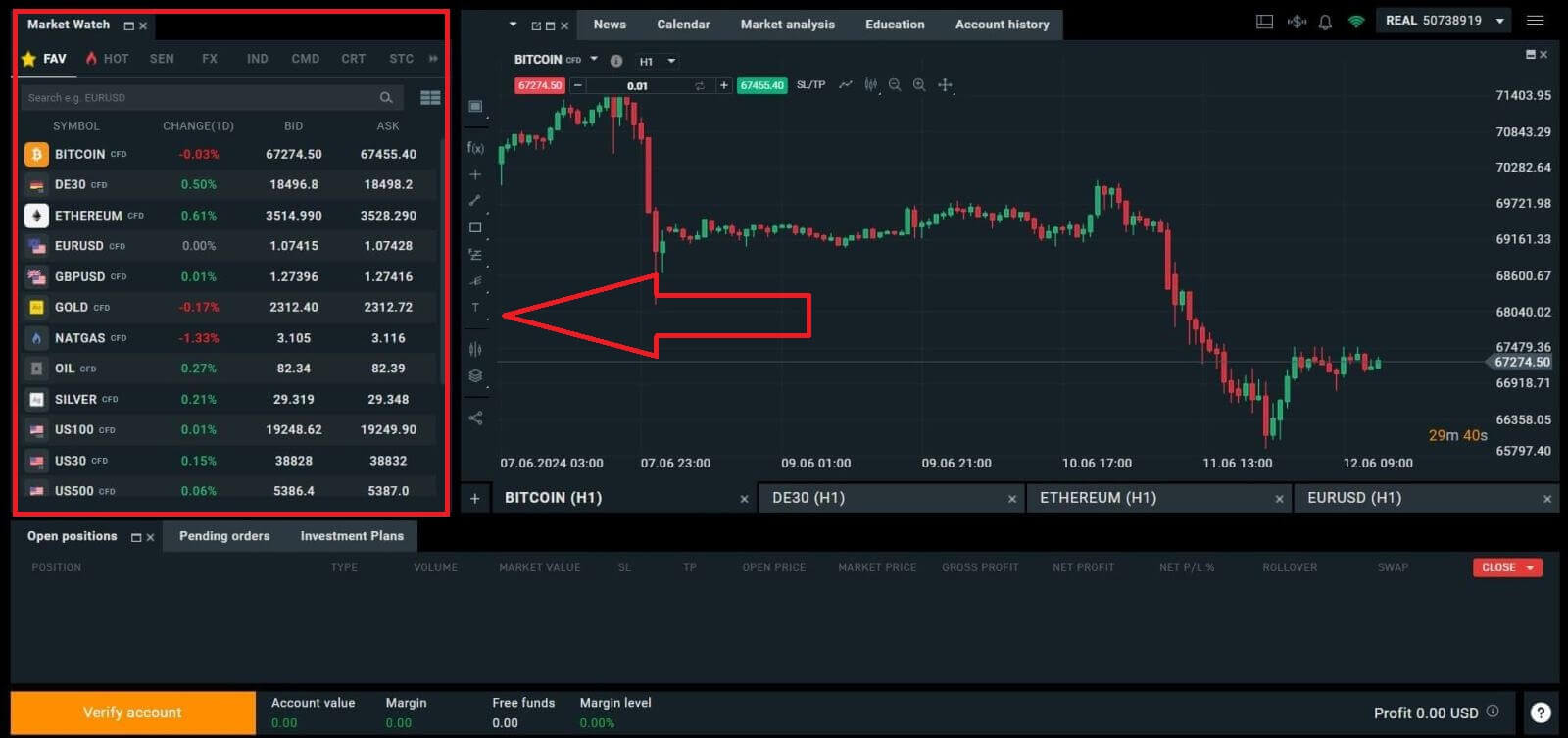

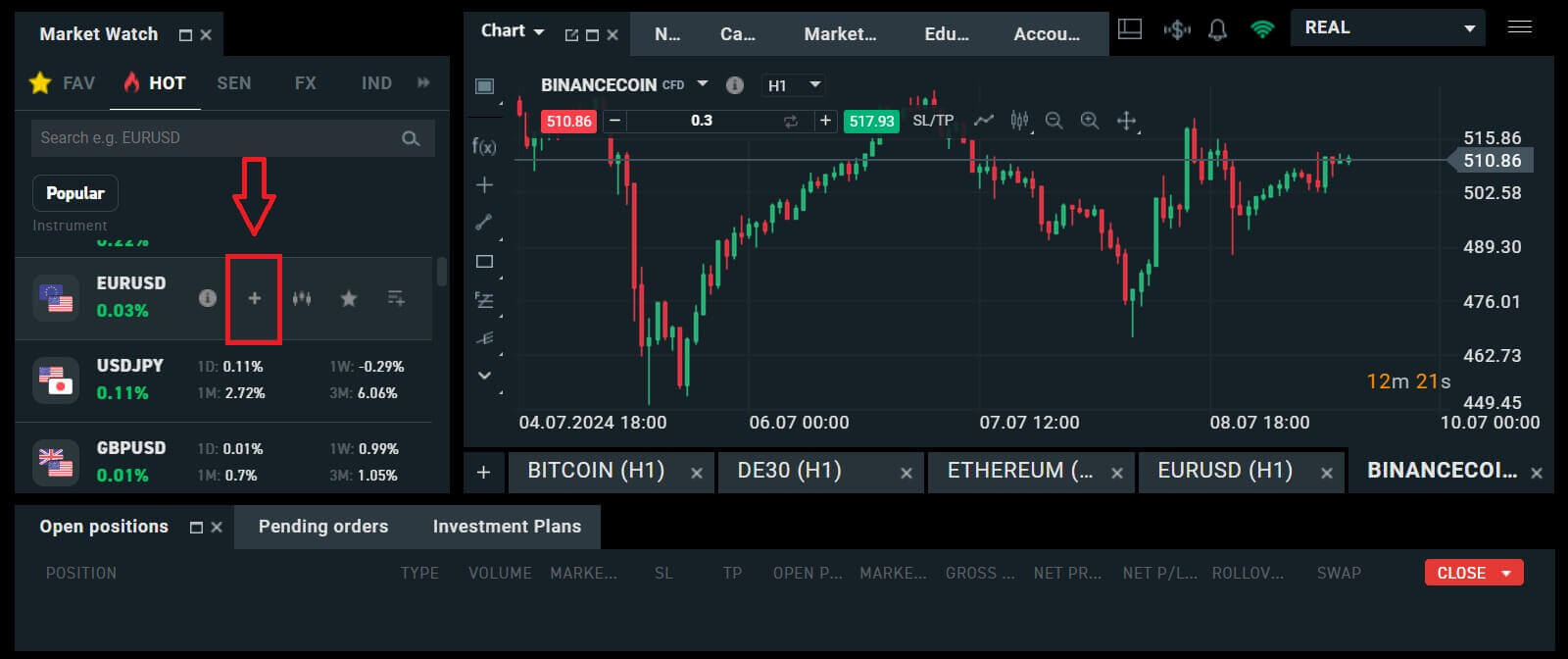

After successfully logging into the xStation 5 homepage, look at the "Market Watch" section on the left side of the screen and select an asset to trade.

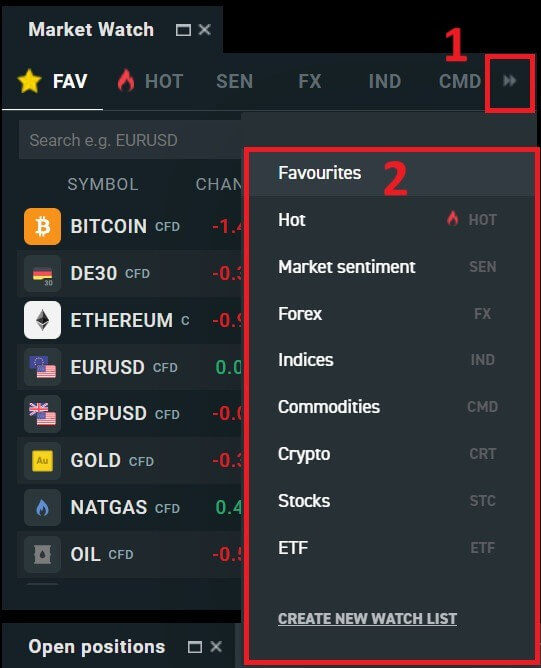

If you do not want to choose from the assets listed in the platform’s suggestions, you can click on the arrow icon (as shown in the illustration below) to view the full list of available assets.

After selecting the desired trading asset, hover your mouse over the asset and click on the plus icon (as shown in the illustration) to enter the order placement interface.

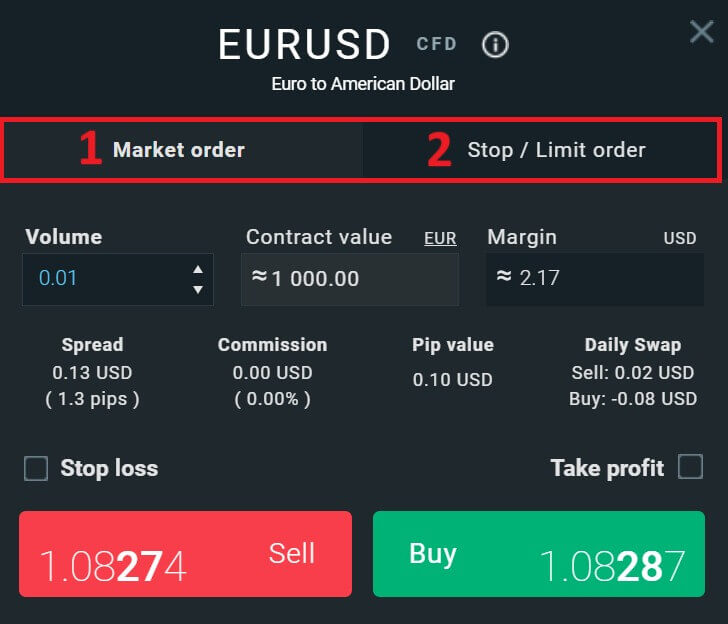

Here, you need to distinguish between two types of orders:

-

Market order: you will execute the trade at the current market price.

-

Stop/ Limit order: you will set a desired price, and the order will automatically activate when the market price reaches that level.

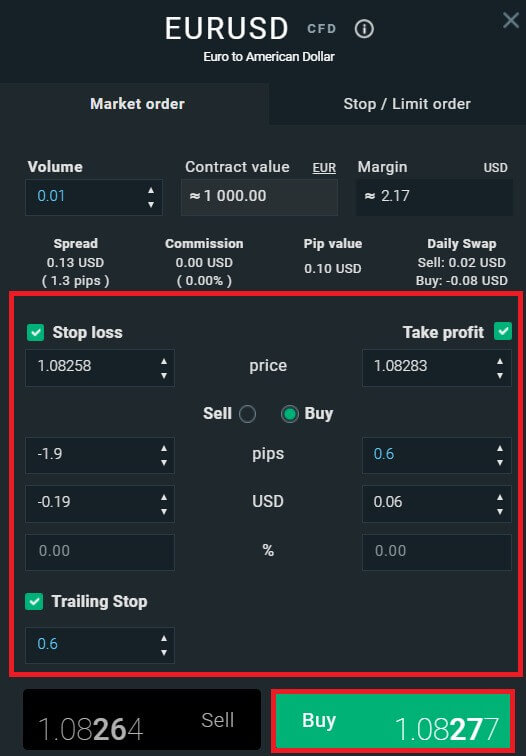

After selecting the appropriate order type for your needs, there are a few optional features that can help enhance your trading experience:

-

Stop Loss: This will be executed automatically when the market moves against your position.

-

Take Profit: This will be executed automatically when the price reaches your specified profit target.

-

Trailing Stop: Imagine you’ve entered a long position, and the market is currently moving favorably, resulting in a profitable trade. At this point, you have the option to adjust your original Stop Loss, which was initially set below your entry price. You can either move it up to your entry price (to break even) or even higher (to lock in a guaranteed profit). For a more automated approach to this process, consider utilizing a Trailing Stop. This tool proves invaluable for risk management, especially during volatile price movements or when you’re unable to actively monitor the market continuously.

It’s crucial to remember that a Stop Loss (SL) or Take Profit (TP) is directly linked to an active position or a pending order. You can modify both once your trade is live and actively monitor market conditions. These orders serve as safeguards for your market exposure, though they are not mandatory for initiating new positions. You can opt to add them at a later stage, but it’s advisable to prioritize protecting your positions whenever possible.

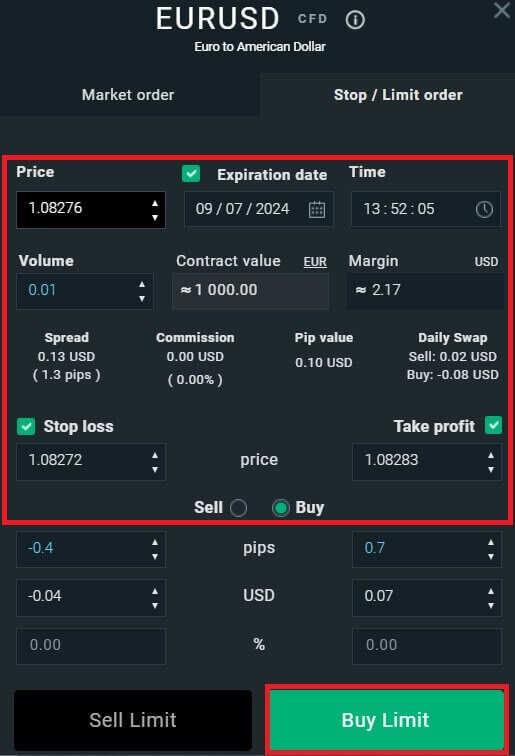

For a Stop/Limit order type, there will be additional order information, specifically:

-

Price: Different from a market order (entering at the current market price), here you need to enter the price level you desire or predict (different from the current market price). When the market price reaches that level, your order will automatically trigger.

-

Expiration date and Time.

-

Volume: the size of the contract

-

Contract value.

-

Margin: the amount of funds in account currency that is withheld by a broker for keeping an order open.

After setting up all the necessary details and configurations for your order, select "Buy/Sell" or "Buy/Sell Limit" to proceed with placing your order.

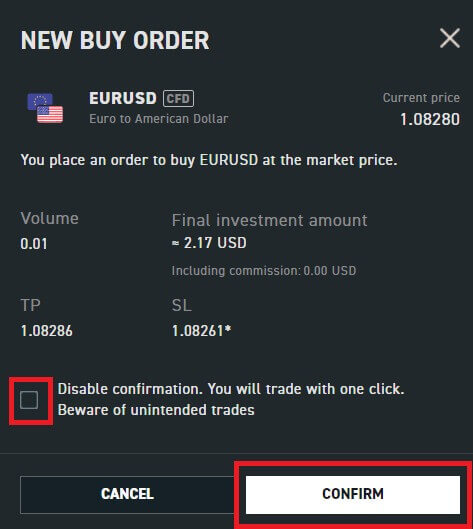

After that, a confirmation window will appear. Please carefully review the order details and then select "Confirm" to complete the order-placing process. You can tick the checkbox to disable notifications for faster transactions.

So with just a few easy steps, you can now start trading on xStation 5. Wish you success!

How to place an Order on XTB [App]

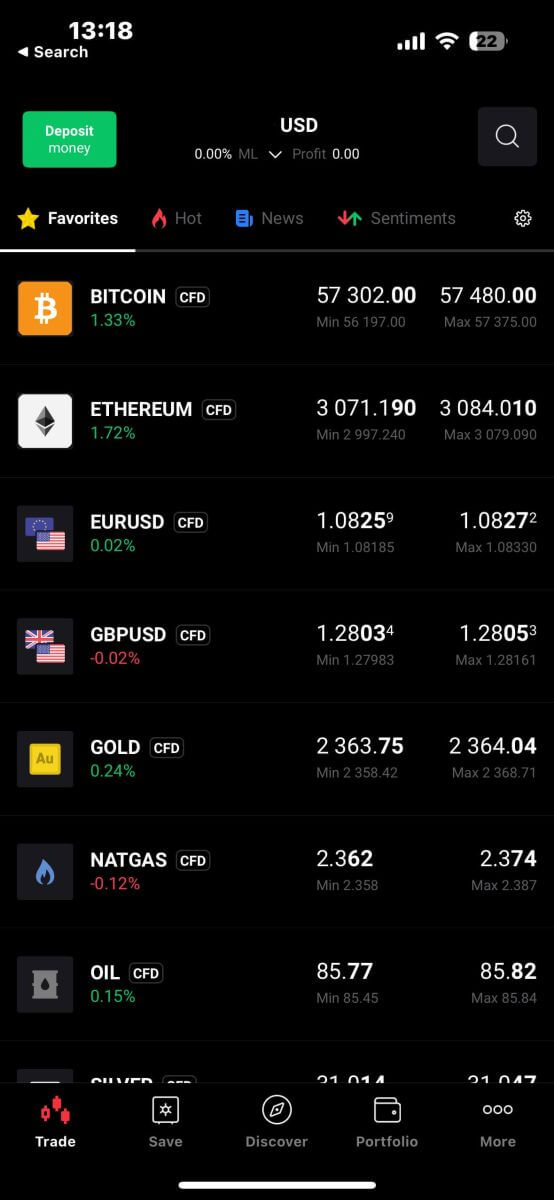

First, download and log in to the XTB - Online Trading app.

Refer to the following article for more details: How to Download and Install XTB Application for Mobile Phone (Android, iOS).

Next, you should choose the assets you want to trade with by tapping on them.

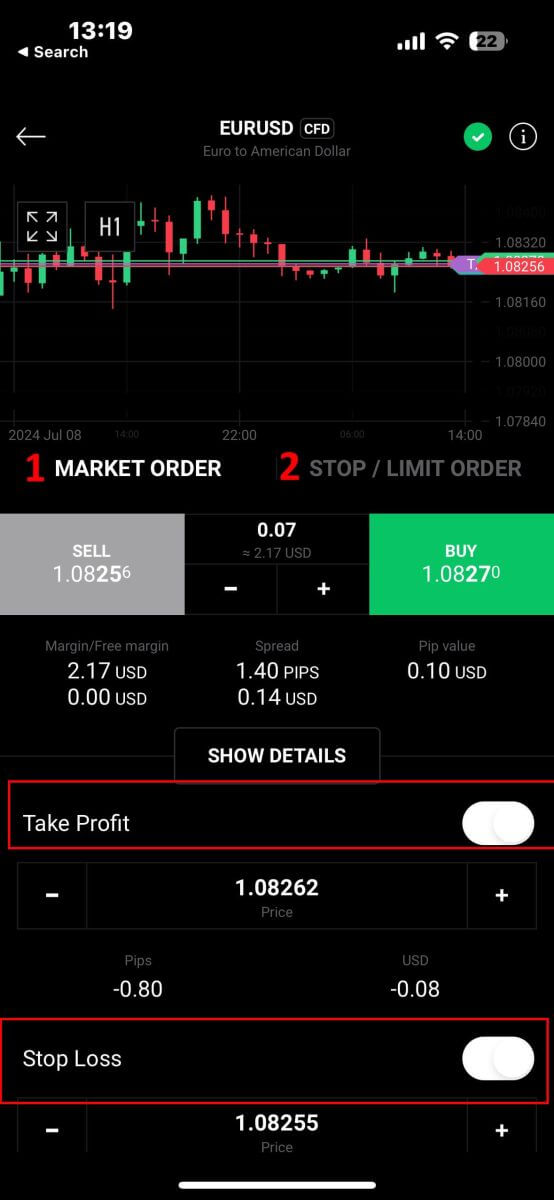

It’s important to differentiate between two types of orders:

-

Market order: This executes the trade immediately at the current market price.

-

Stop/Limit order: With this type of order, you specify a desired price level. The order will trigger automatically once the market price reaches that specified level.

Once you’ve selected the right order type for your trading strategy, there are additional tools that can significantly enhance your trading experience:

-

Stop Loss (SL): This feature automatically triggers to limit potential losses if the market moves unfavorably against your position.

-

Take Profit (TP): This tool ensures automatic execution when the market reaches your predetermined profit target, securing your gains.

It’s essential to understand that both Stop Loss (SL) and Take Profit (TP) orders are directly linked to active positions or pending orders. You have the flexibility to adjust these settings as your trade progresses and as market conditions evolve. While not mandatory for opening new positions, incorporating these risk management tools is highly recommended to safeguard your investments effectively.

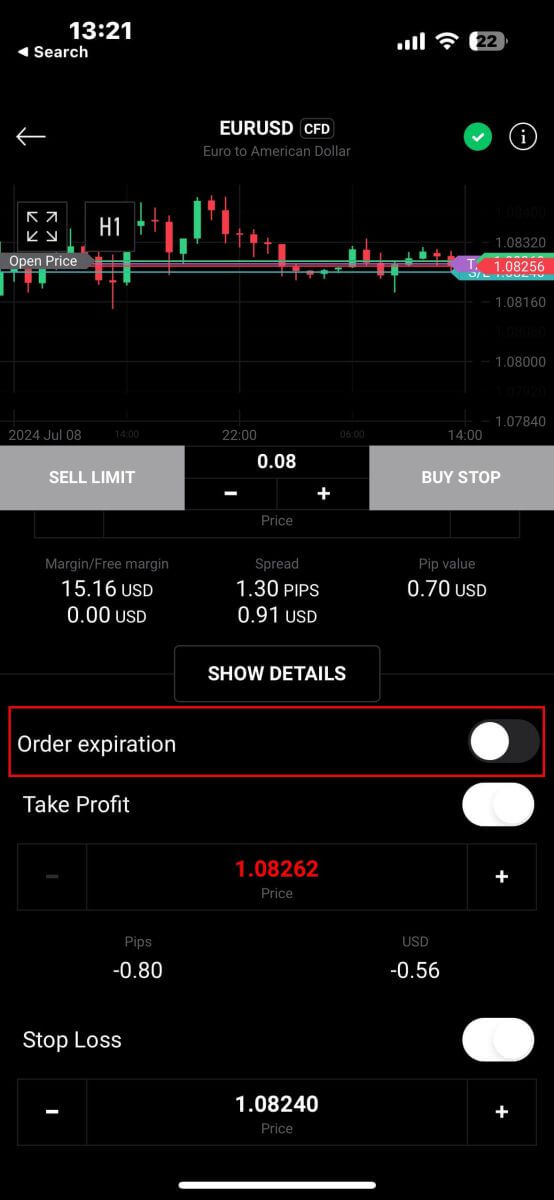

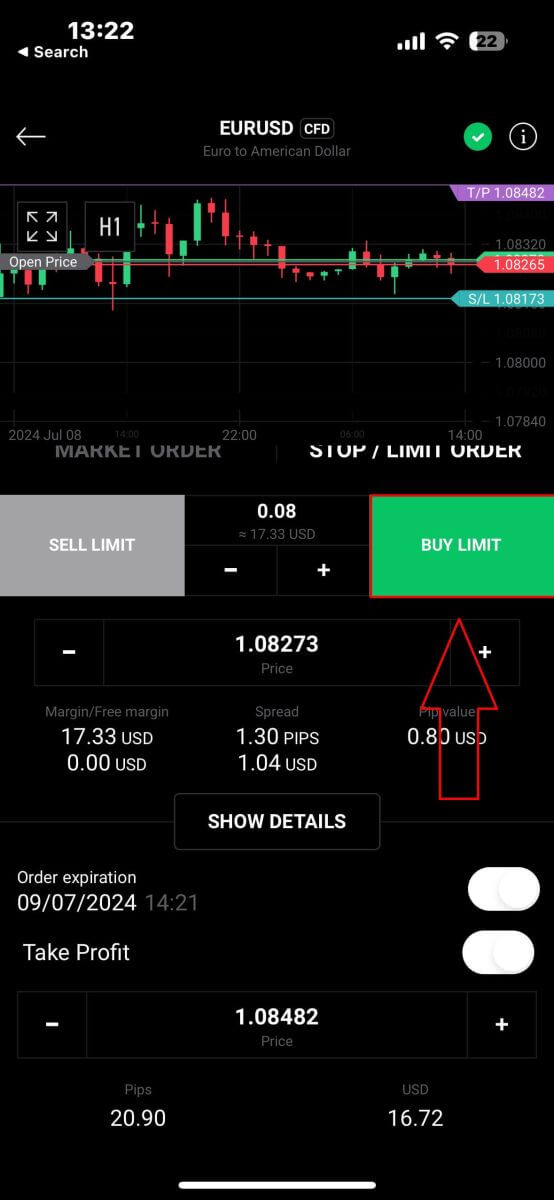

When opting for a Stop/Limit order type, you’ll need to provide additional details specific to this order:

-

Price: Unlike a market order that executes at the current market price, you specify a price level you anticipate or desire. The order will activate automatically once the market reaches this specified level.

-

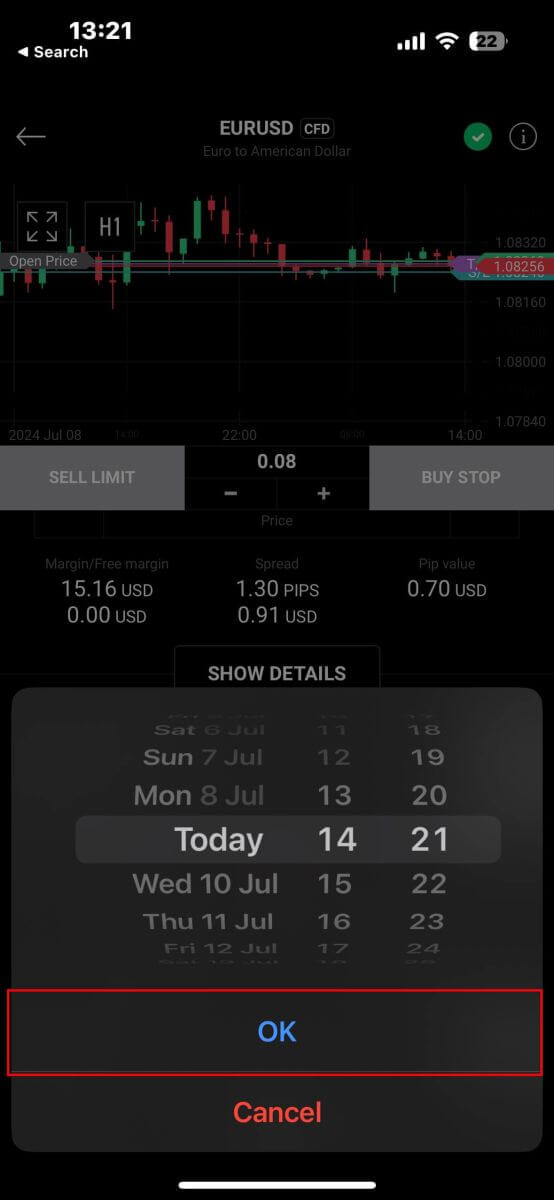

Expiration Date and Time: This specifies the duration for which your order remains active. After this period, if not executed, the order will expire.

After selecting the expiry date and time you prefer, tap "OK" to complete the process.

Once you’ve configured all the necessary parameters for your order, proceed by selecting "Buy/Sell" or "Buy/Sell Limit" to place your order effectively.

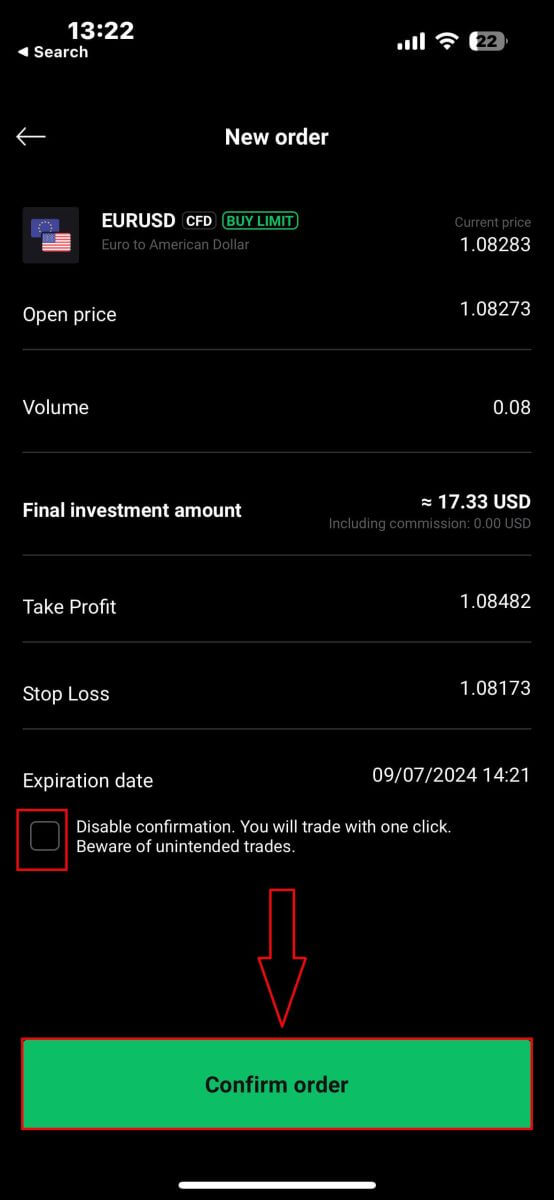

Following that, a confirmation window will pop up. Take a moment to thoroughly review the order details.

Once you’re satisfied, click on "Confirm order" to finalize the order placement. You may also opt to check the box to disable notifications for expedited transactions.

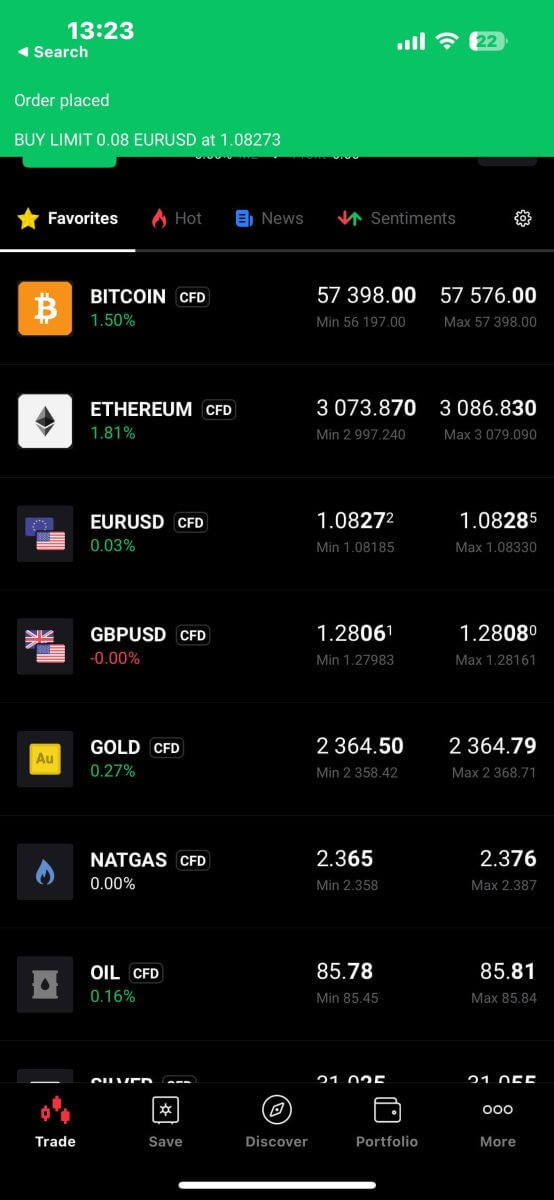

Congratulations! Your order has been successfully placed through the mobile app. Happy trading!

How to close Orders on XTB

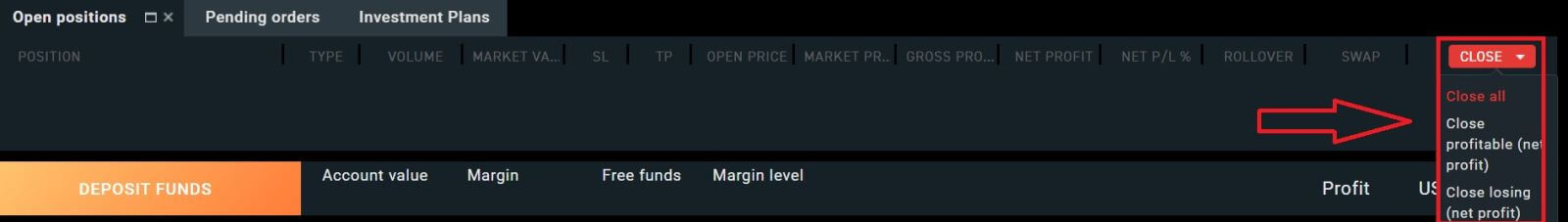

To close multiple orders at once, you can select the Close button at the bottom right corner of the screen with the following options:

-

Close all.

-

Close profitable (net profit).

-

Close losing (net profit).

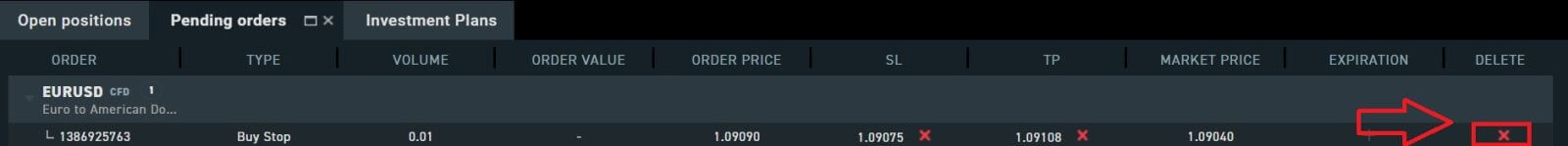

To manually close each order, click the "X" button at the bottom right corner of the screen corresponding to the order you want to close.

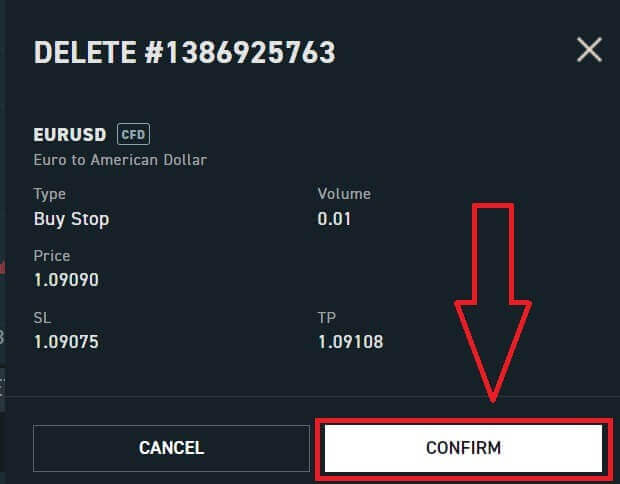

A window will immediately appear with the order details for you to review. Select "Confirm" to proceed.

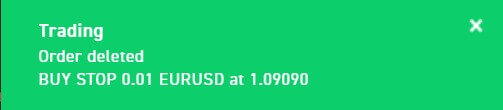

Congratulations, you have successfully closed the order. It’s really easy with XTB xStation 5.

Frequently Asked Questions (FAQ)

Trading Platform at XTB

At XTB, we offer only one trading platform, xStation - developed exclusively by XTB.

From April 19, 2024, XTB will stop providing trading services on the Metatrader4 platform. Old MT4 accounts at XTB will be automatically transferred to the xStation platform.

XTB does not offer ctrader, MT5, or Ninja Trader platforms.

Market news update

At XTB, we have a team of award-winning analysts who constantly update the latest market news and analyze that information to help our clients make their investment decisions. This includes information such as:-

Latest news from financial markets and the world

-

Market analysis and strategic pricing milestones

-

In-depth commentary

-

Market Trends - Percentage of XTB clients who are open Buy or Sell positions on each symbol

-

Most volatile - the stocks that are gaining or losing the most in price over a selected time

-

Stock/ETF Scanner - use the available filters to select the stocks/ETFs that best suit your requirements.

-

Heatmap - reflects an overview of the stock market situation by region, the rate of increase and decrease in a predetermined period.

xStation5 - Price Alerts

Price Alerts on xStation 5 can automatically notify you when the market reaches key price levels set by you without having to spend all day in front of your monitor or mobile device.

Setting price alerts on xStation 5 is very easy. You can add a price alert simply by right-clicking anywhere on the chart and selecting ’Price Alerts’.

Once you have opened the Alerts window, you can set a new alert by (BID or ASK) and a condition that must be met to trigger your alert. You can also add a comment if you wish. Once you have successfully set it up, your alert will appear on the list of ’Price Alerts’ at the top of the screen.

You can easily modify or delete alerts by double-clicking on the price alert list. You can also enable/disable all alerts without deleting them.

Price alerts effectively assist in managing positions and setting up intraday trading plans.

Price alerts are only displayed on the xStation platform, not sent to your inbox or phone.

What’s the minimum amount I can invest in a real share/ stock?

Important: Shares and ETFs are not offered by XTB Ltd (Cy)

The minimum amount you can invest in a stock is £10 per trade. Real Shares and ETFs investing is 0% commission equivalent up to €100,000 per calendar month. Investments at or above €100,000 per calendar month will be charged a 0.2% commission.

If you have any further questions please do not hesitate to contact a member of our sales team at +44 2036953085 or by emailing us at [email protected].

For any non-UK clients, please visit https://www.xtb.com/int/contact select the country you have registered with, and contact a member of our staff.

XTB offers a wide range of educational articles teaching you all you need to know about trading.

Start your trading journey now.

Do you charge an exchange rate for trading shares valued in other currencies?

XTB has recently introduced a new feature, Internal Currency Exchange! This feature allows you to easily transfer funds between your trading accounts denominated in different currencies.

How does it work?

-

Access Internal Currency Exchange directly through the "Internal Transfer" tab within your Client Office.

-

This service is available to all clients

-

To utilize this service, you’ll need a minimum of two trading accounts, each in a different currency.

Fees

- Each currency exchange will incur a commission charged to your account. The rate will vary:

-

Weekdays: 0.5% commission

-

Weekends Holidays: 0.8% commission

-

-

For security purposes, there will be a maximum transaction limit equivalent to up to 14,000 EUR per currency exchange.

-

Rates will be displayed and calculated to 4 decimal places for all currencies.

T and Cs

-

You’ll be notified if a significant exchange rate fluctuation occurs, requiring you to confirm the transaction again or restart the process.

-

We have implemented a verification mechanism to ensure this service is used for legitimate trading purposes. In rare cases where misuse is suspected, the team may restrict access to internal currency exchange for your account.

What are rollovers?

Most of our Indices and Commodities CFDs are based on future contracts.

Their price is very transparent, but it also means they are subject to monthly or quarterly ’Rollovers’.

The future contracts we price our Indices or Commodities markets on normally expire after 1 or 3 months. Therefore, we must switch (rollover) our CFD price from the old contract to the new futures contract. Sometimes the price of old and new futures contracts are different, so we must do a Rollover Correction by adding or deducting a one-time-only swap credit/charge on the trading account at the rollover date to reflect the change in market price.

The correction is completely neutral for the net profit on any open position.

For example:

The current price of the old OIL future contract (expiring) is 22.50

The current price of the new OIL future contract (to which we switch the CFD price) is 25.50

Rollover Correction in swaps is $3000 per lot = (25.50-22.50) x 1 lot i.e. $1000

If you have a long position - BUY 1 lot of OIL at 20.50.

Your profit before rollover is $2000 = (22.50-20.50) x 1 lot i.e. $1000

Your profit after rollover is also $2000 = (25.50-20.50) x 1 lot - $3000 (Rollover Correction)

If you have a short position - SELL 1 lot of OIL at 20.50.

Your profit before rollover is -$2000 =(20.50-22.50) x 1 lot i.e. $1000

Your profit after rollover is also -$2000 =(20.50-25.50) x 1 lot + $3000 (Rollover Correction)

What leverage do you offer?

The type of leverage you can get at XTB is dependent on your location.

UK Residents

We onboard UK clients to XTB Limited (UK), which is our FCA-regulated entity.

EU Residents

We onboard EU clients to XTB Limited (CY), which is regulated by the Cyprus Securities and Exchange Commission.

In the UK/Europe under current regulations, leverage is restricted to a maximum of 30:1 for ’retail classified’ clients.

Non-UK/EU Residents

We only onboard non-UK/EU residents to XTB International, which is solely authorized and regulated by the IFSC Belize. Here you can trade with leverage up to 500:1.

MENA Region Residents

We only onboard Middle East and North African residents to XTB MENA Limited, which is authorized and regulated by the Dubai Financial Services Authority (DFSA) in the Dubai International Financial Centre (DIFC), in the United Arab Emirates. Here you can trade with leverage up to 30:1.

Inactive Account Maintenance Fee

Like other brokers, XTB will charge an account maintenance fee when a client has not traded for 12 months or more and has not deposited money into the account in the last 90 days. This fee is used to pay for the service of constantly updating data on thousands of markets around the world to the client.

After 12 months from your last transaction and no deposit within the last 90 days, you will be charged 10 Euros per month (or the equivalent amount converted to USD)

Once you start trading again, XTB will stop charging this fee.

We do not want to charge any fees for providing customer data, so any regular customers will not be charged this type of fee.

How to withdraw money from XTB

Withdrawal rules on XTB

Withdrawals can be made at any time, giving you 24/7 access to your funds. To withdraw money from your account, navigate to the Withdrawal section of your Account Management. You can check the status of your withdrawal at any time in the Transaction History.

Money can be sent back only to the bank account under your own name. We will not send your funds to any 3rd party bank accounts.

-

For Clients who have an account with XTB Limited (UK), there is no fee charged for withdrawals as long as they are above £60, €80, or $100.

-

For Clients who have an account with XTB Limited (CY), there is no fee charged for withdrawals as long as they are above €100.

-

For Clients who have an account with XTB International Limited, there is no fee charged for withdrawals as long as they are above $50.

Please refer to the below for the withdrawal processing time:

-

XTB Limited (UK) - on the same day as long as the withdrawal is requested before 1pm (GMT). Requests made after 1pm (GMT) will be processed the next working day.

-

XTB Limited (CY) - not later than the next business day following the day on which we received the withdrawal request.

-

XTB International Limited - Standard processing time for withdrawal requests is 1 business day.

XTB covers all costs charged by our bank.

All other potential costs (Beneficiary and Intermediary bank) are paid by the client according to the commission tables of those banks.

How to Withdraw Money from XTB [Web]

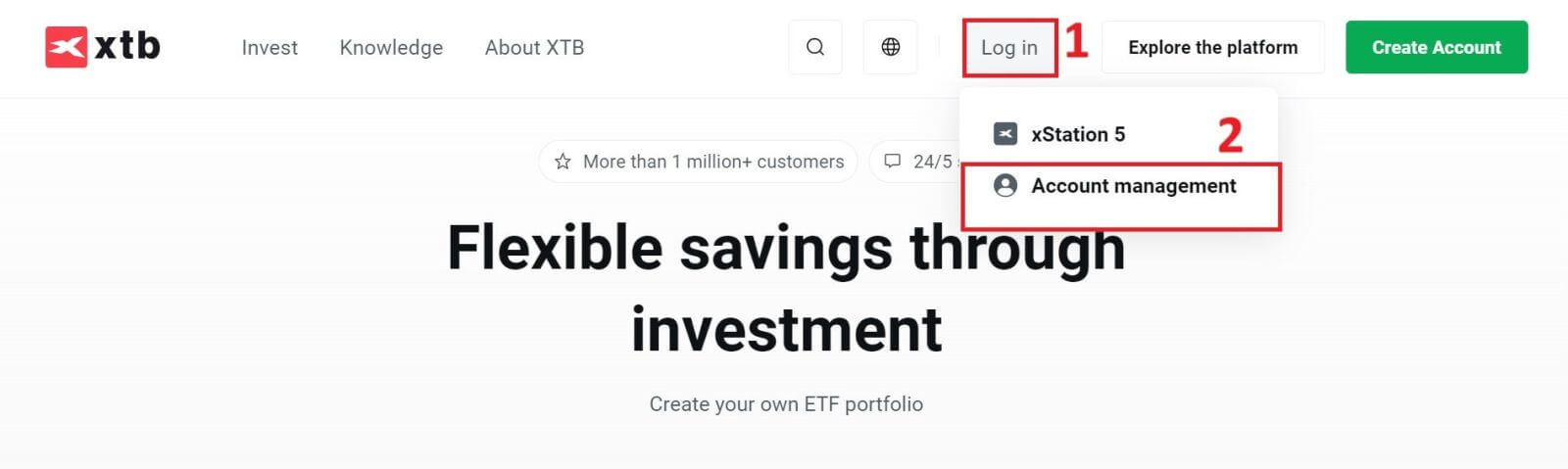

Start by visiting the XTB homepage. Once there, choose "Log in" and then proceed to "Account management".

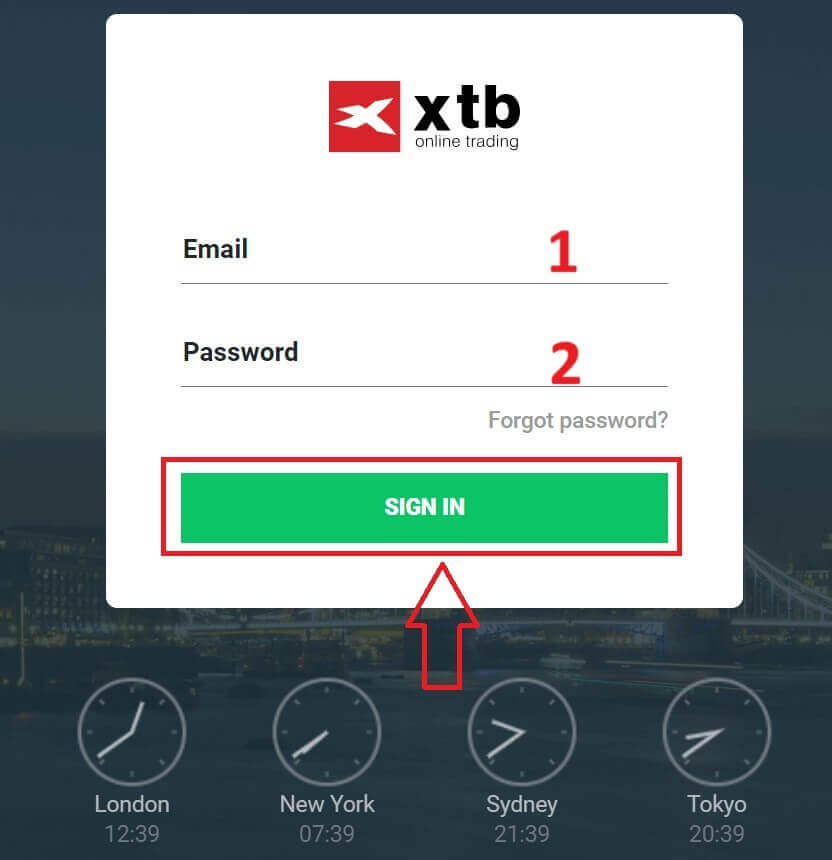

You will then be taken to the login page. Enter the login details for the account you previously created in the designated fields. Click "SIGN IN" to continue.

If you haven’t signed up for an XTB account yet, please refer to the instructions provided in this article: How to Register Account on XTB.

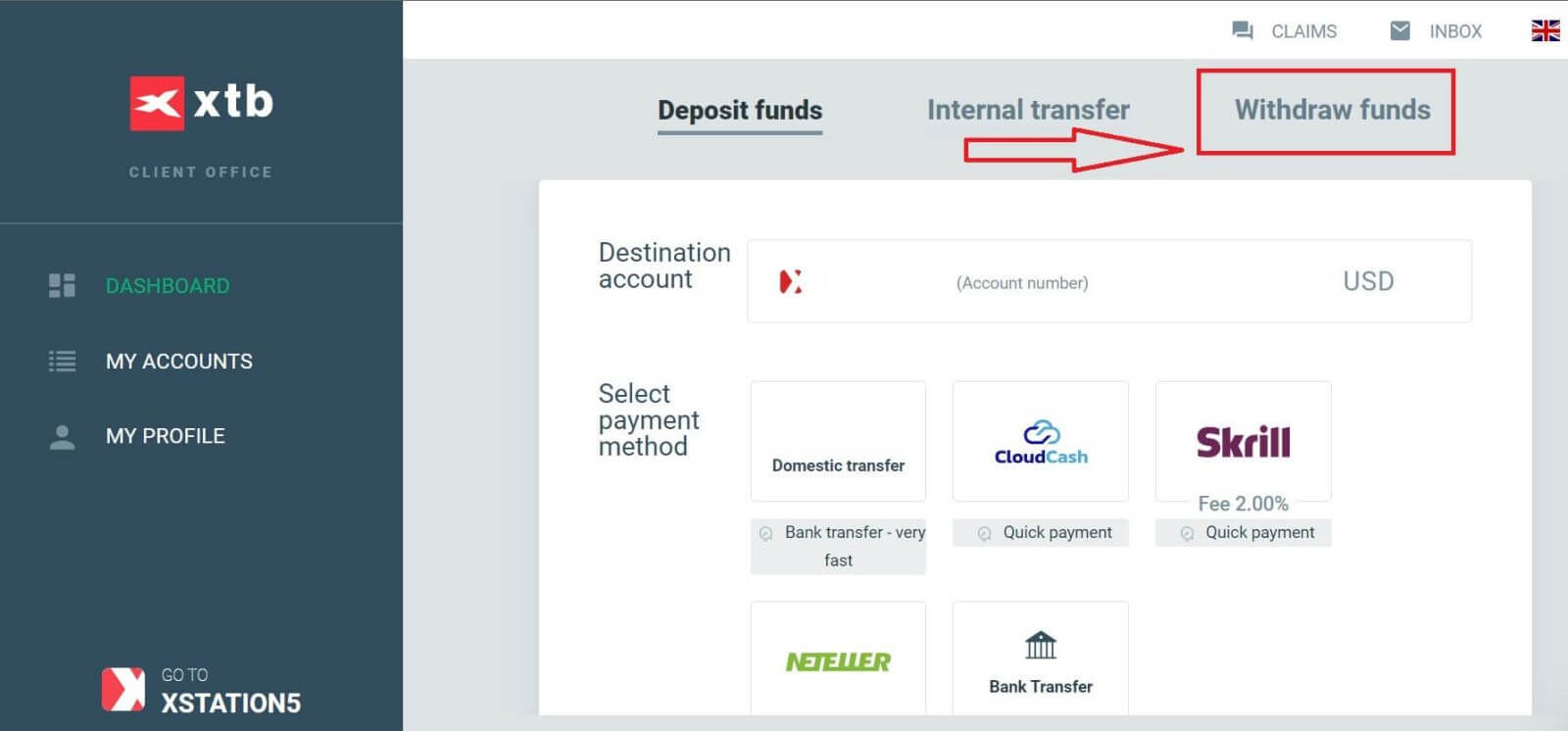

In the Account Management section, click on "Withdraw funds" to enter the withdrawal interface.

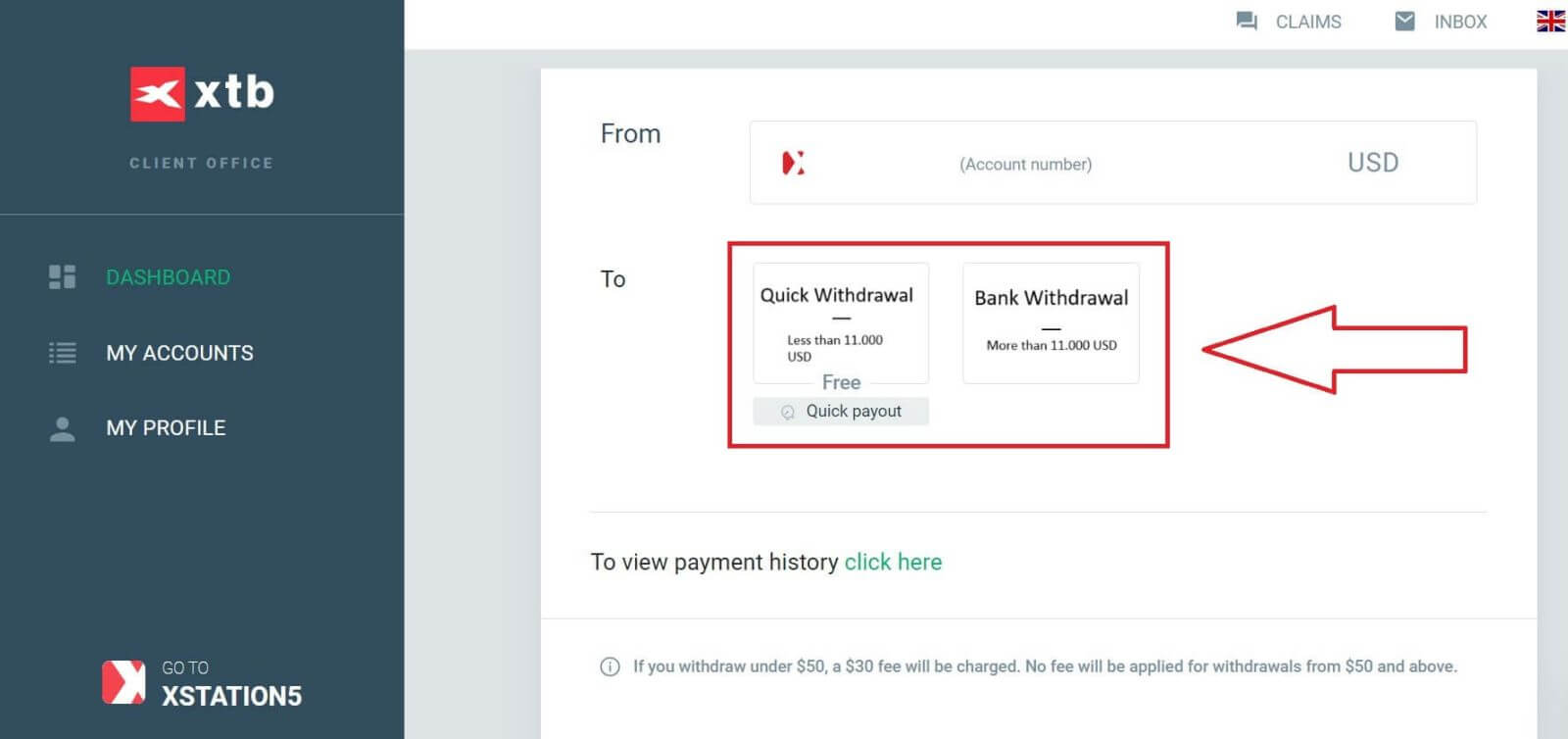

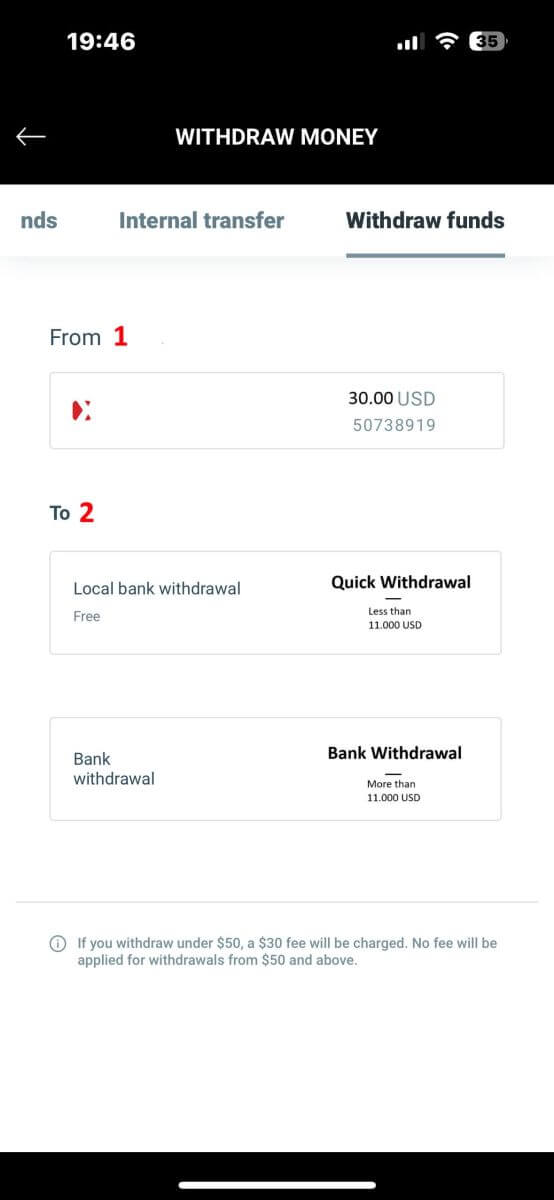

Currently, XTB supports withdrawal transactions through Bank Transfer under the following two forms depending on the amount you wish to withdraw:

-

Quick Withdrawal: less than 11.000 USD.

-

Bank Withdrawal: more than 11.000 USD.

If the withdrawal amount is $50 or less, you will be charged a $30 fee. If you withdraw more than $50, it is completely free.

Express withdrawal orders will be successfully processed to bank accounts within 1 hour if the withdrawal order is placed during business hours on weekdays.

Withdrawals made before 15:30 CET will be processed the same day the withdrawal is made (excluding weekends and holidays). The transfer usually takes 1-2 business days.

All costs that may arise (when transferring between banks) will be paid by the customer according to the regulations of those banks.

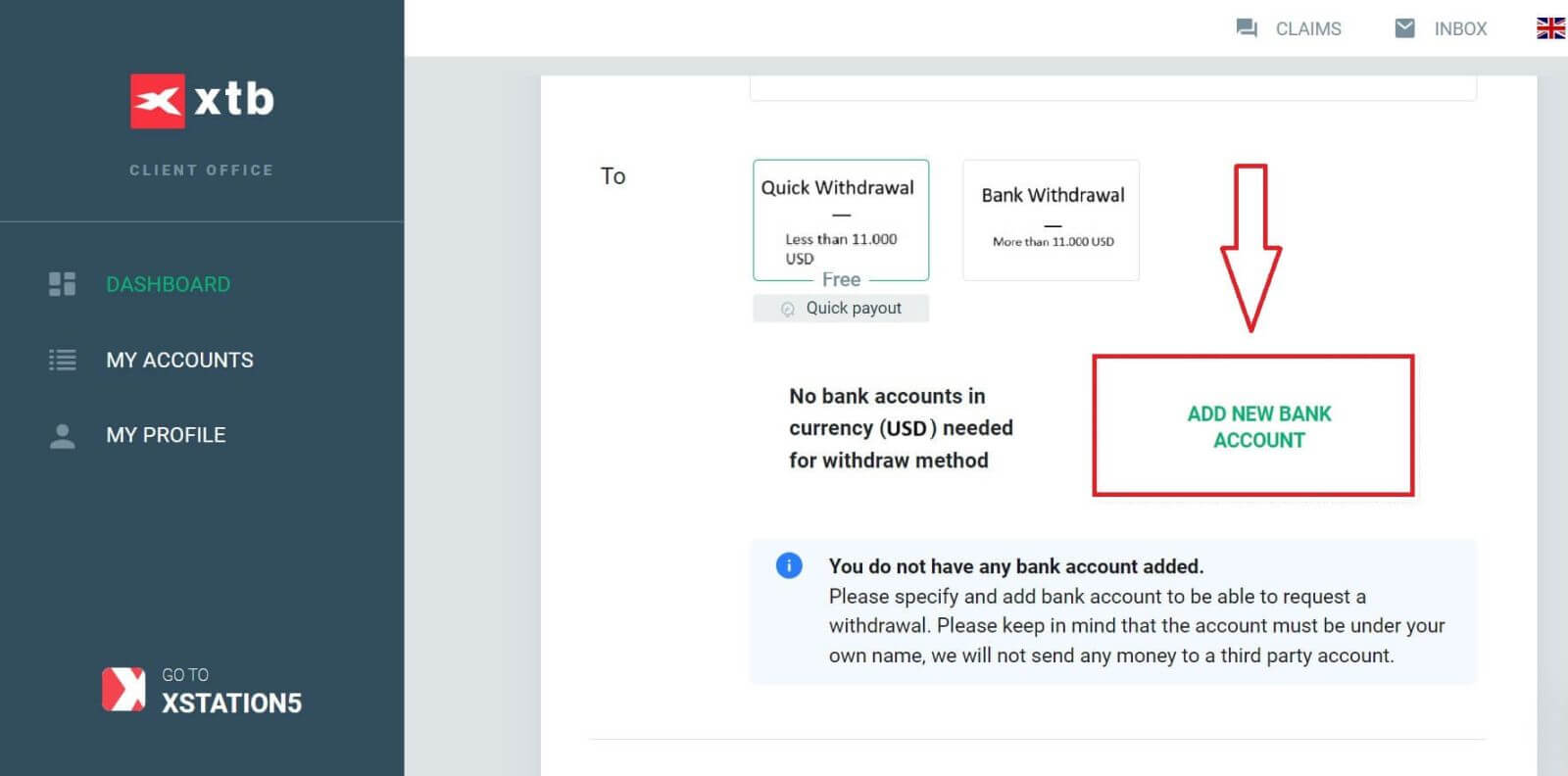

The next step is to select the beneficiary bank account. If you don’t have your bank account information saved in XTB, choose "ADD NEW BANK ACCOUNT" to add it.

You can only withdraw funds to an account in your own name. XTB will refuse any withdrawal request to a third-party bank account.

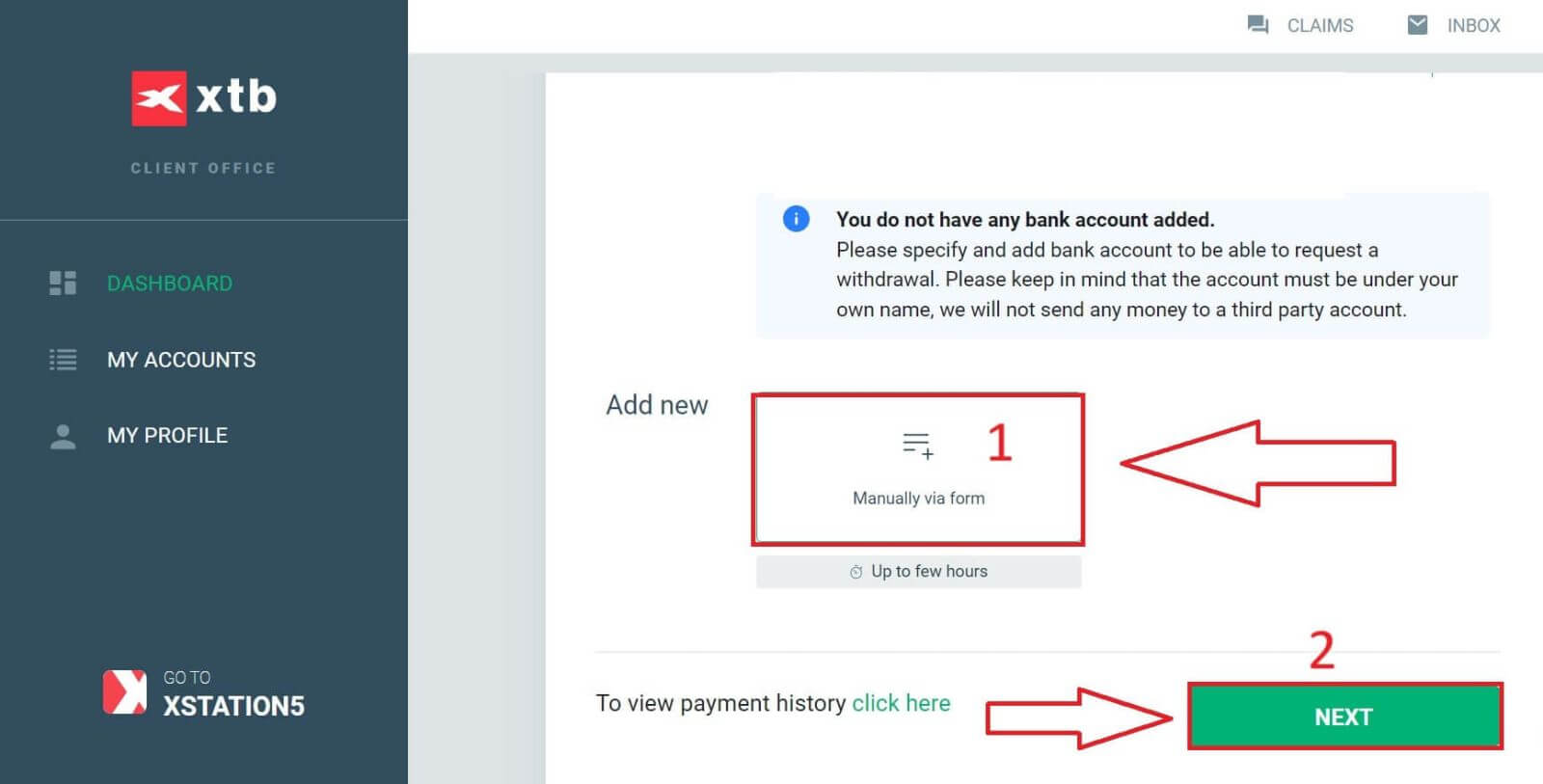

At the same time, select "Manually via form" and then click "Next" to manually enter your bank account information.

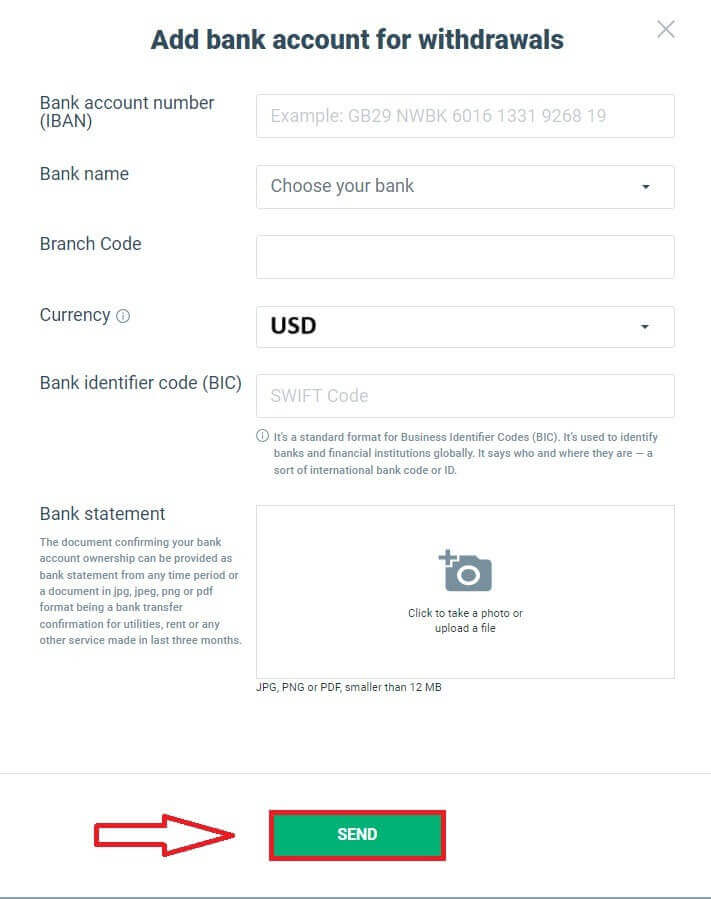

Below are some of the required fields you need to fill in the form:

-

Bank account number (IBAN).

-

Bank name (the international name).

-

Branch Code.

-

Currency.

-

Bank identifier code (BIC) (You can find this code on the authentic website of your bank).

-

Bank Statement (The document in JPG, PNG, or PDF confirming your bank account ownership).

After completing the form, select "SEND" and wait for the system to verify the information (this process can take from a few minutes to a few hours).

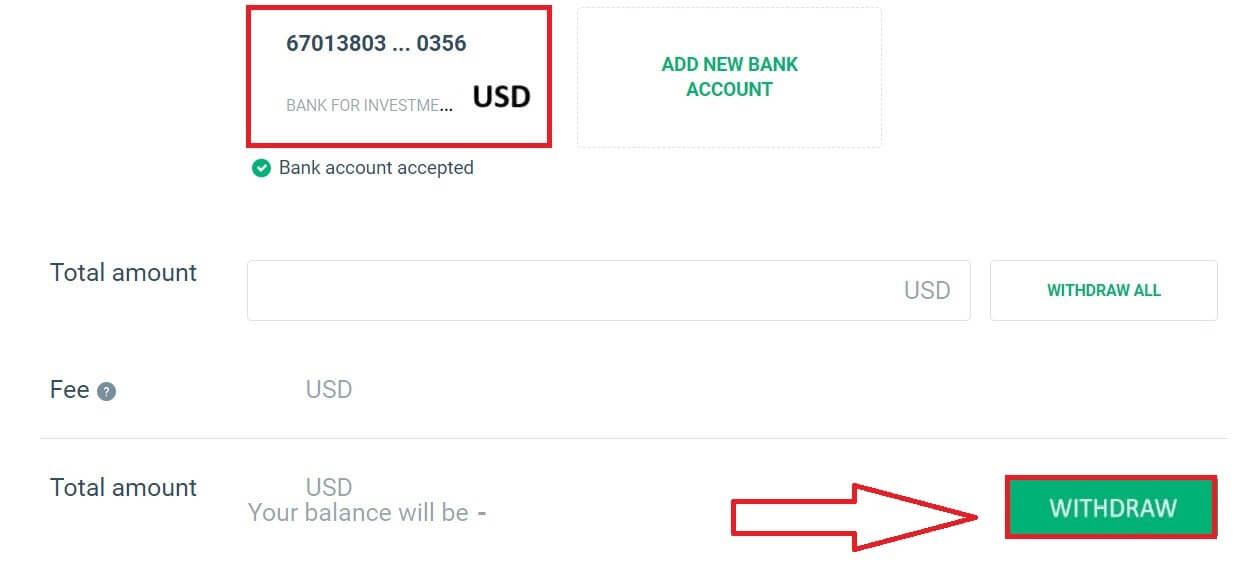

Once your bank account is verified by XTB, it will be added to the list as shown below and become available for withdrawal transactions.

Next, enter the amount you want to withdraw into the corresponding field (the maximum and minimum withdrawal amounts depend on the withdrawal method you choose and the balance in your trading account).

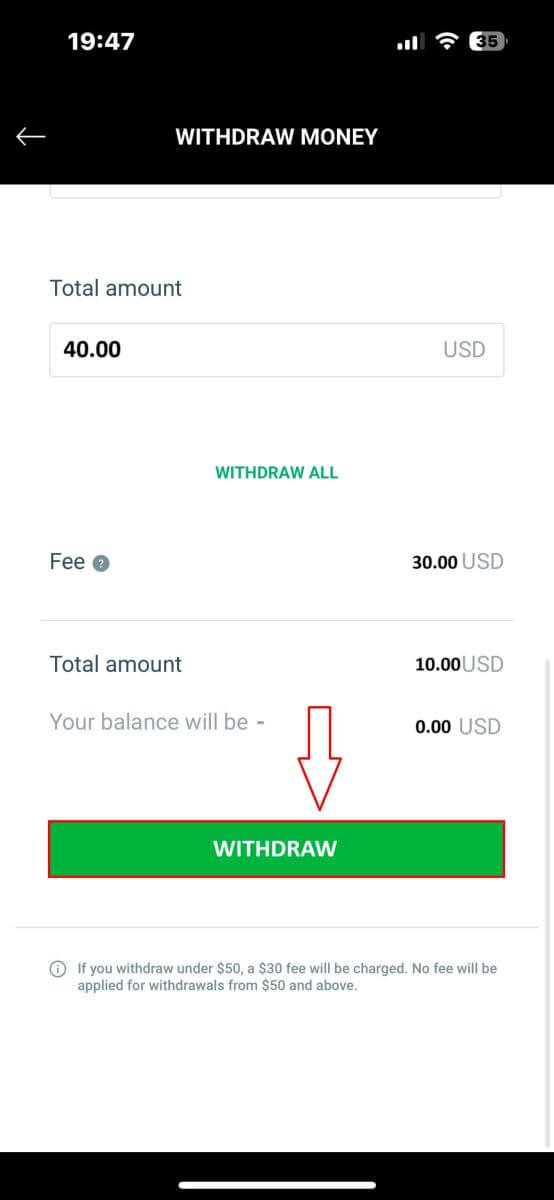

Please note the "Fee" and "Total amount" sections to understand the amount you will receive in your bank account. Once you agree with the fee (if applicable) and the actual amount received, select "WITHDRAW" to complete the withdrawal process.

How to Withdraw Money from XTB [App]

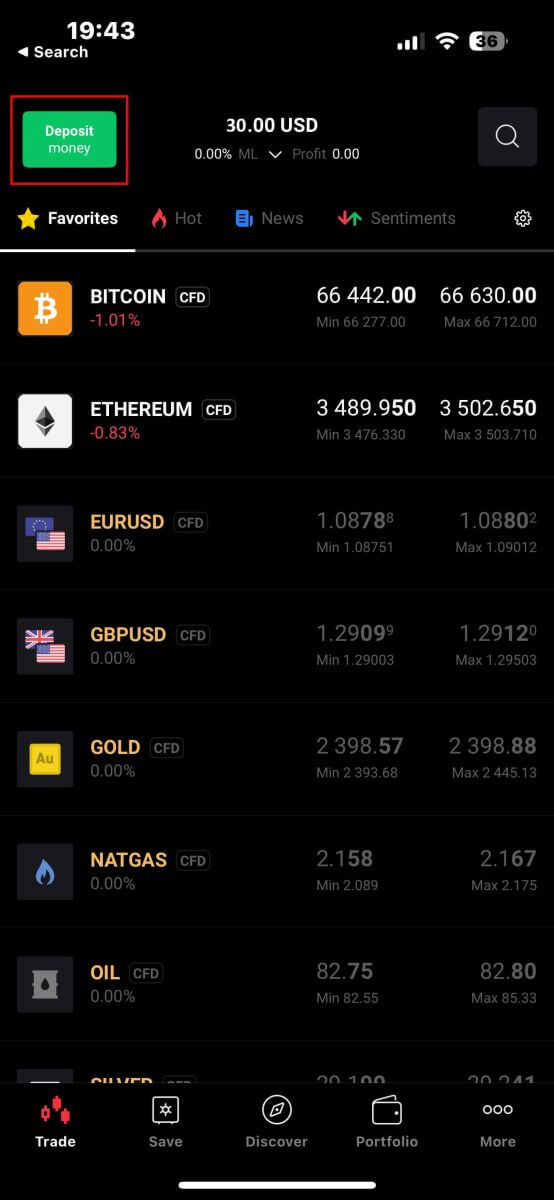

Start by opening the XTB Online Trading app on your mobile device and make sure you’re logged in. Then, tap "Deposit Money" located at the top left corner of the screen.

If you haven’t installed the app yet, please check the article provided for installation instructions: How to Download and Install XTB Application for Mobile Phone (Android, iOS)

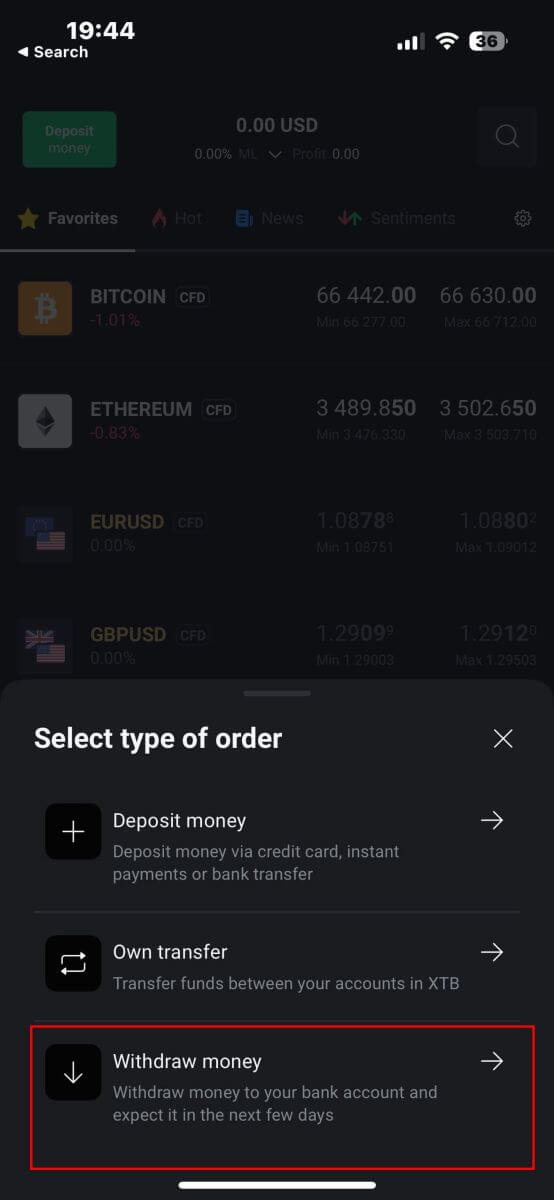

Next, in the "Select type of order" panel, choose "Withdraw Money" to proceed.

Then, you will be directed to the "Withdraw Money" screen, where you should:

-

Select the account that you wish to withdraw.

-

Selec the withdraw method depending on the amount of money that you wish to withdraw.

Once you finish, please scroll down for the next steps.

Here are some important details you need to focus on:

-

Enter the amount of money that you wish to withdraw in the blank.

-

Check the fee (if applicable).

-

Check the total amount of money deposited into your account after deducting any fees (if applicable).

After completing all the above steps, select "WITHDRAW" to proceed with the withdrawal.

NOTE: If you withdraw under 50$, a 30$ fee will be charged. No fee will be applied for withdrawals from 50$ and above.

The following steps will take place within your banking app, so follow the on-screen instructions to complete the process. Good luck!

Frequently Asked Questions (FAQ)

Where can I check the status of my withdrawal order?

To check the status of your withdrawal order, please log in to Account Management - My Profile - Withdrawal History.

You will be able to check the date of the withdrawal order, the withdrawal amount as well as the status of the withdrawal order.

Change bank account

To change your bank account, please log in to your Account Management page, My Profile - Bank Accounts.

Then click the Edit icon, complete the required info, and motion, and upload a document confirming the bank account holder.

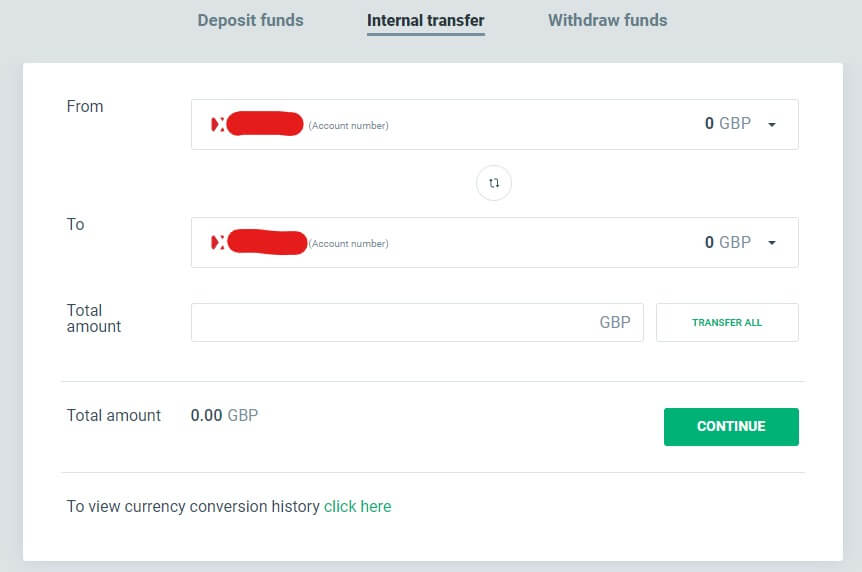

Can I transfer funds between trading accounts?

Yes! It is possible to transfer funds between your real trading accounts.

Fund transfer is possible both for trading accounts in the same currency and in two different currencies.

🚩Fund transfers between trading accounts in the same currency are free of charge.

🚩Fund transfers between trading accounts in two different currencies are subject to a fee. Each currency conversion involves charging a commission:

-

0.5% (currency conversions performed on weekdays).

-

0.8% (currency conversions performed on weekends and holidays).

More details about commissions can be found in the Table of Fees and Commissions: https://www.xtb.com/en/account-and-fees.

To transfer funds, please login to the Client Office - Dashboard - Internal transfer.

Select the accounts between which you would like to transfer money, enter the amount, and Continue.

Conclusion: Efficient Forex Trading and Easy Withdrawals with XTB

Trading forex and withdrawing funds on XTB is designed to be intuitive and efficient. The platform offers advanced trading tools and resources, ensuring you can execute forex trades with ease and precision. When it comes to withdrawals, XTB provides a straightforward and secure process, allowing you to access your funds promptly. With XTB’s user-friendly interface, robust security features, and excellent customer support, managing your trades and finances is both convenient and reliable. This seamless experience enables you to focus on your trading strategies and market analysis, ensuring a productive and stress-free trading journey.